How to get a Construction Loan

How to Get a Construction Loan

A large portion of the population has purchased a home, but there are many people out there that would like to purchase land and build a home.

Some of these people do not know where to start. A construction loan is not the same as a traditional home loan, it is a little more involved. Although there are more steps, it does not have to be difficult, you just have to know what is required. Over the next 11 weeks we will be covering the steps to getting a construction loan.

Step 1 – Know Your Loan Options

It is wise to do some research about construction loans. Not all construction loans are created equal. Just like any product, there are good loans and bad loans. It's important to understand the specifics of a loan and be able to apply those specifics to your situation. As an example do you plan to do a lot of the work on your new home, if so a loan that requires the build to be complete in 4 months may not be your best option.

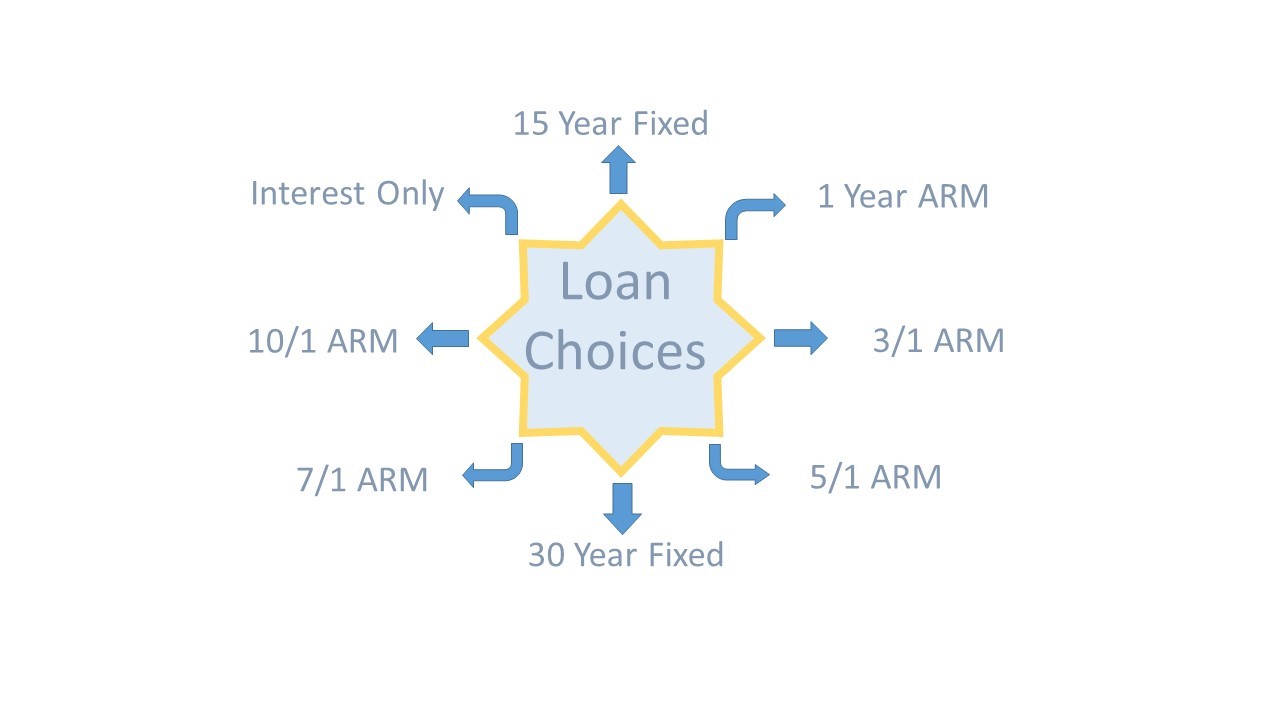

Today's construction loan choices include the 30 year fixed, 15 year fixed, 1 year ARM, 3/1 ARM, 5/1 ARM, 7/1 ARM, 10/1 ARM and the popular interest-only loans. You can get a short term 1 year loan that you have to refinance into a new conventional mortgage loan once the construction is completed. This two time process costs you two sets of closing costs and you have to re-qualify for the new loan once the home is completed, but you also have more flexibility when shopping for conventional mortgages than when you're dealing solely with construction lenders. A popular construction loan today is the "one time close", also known as the "all-in-one," "rollover" or "construction-to-permanent" loan. You have one set of fees and one closing.

Log in next week to see how to "Get Pre-Qualified for your loan".